Excluding properties in Northern Ireland. Your property may be at risk if you do not keep up with payments. T&Cs apply.

Invest in UK property

Our Property Finance offering now extends to Scotland, alongside England and Wales.

To support your plans, Property Finance rates now start from 4.85% AER.

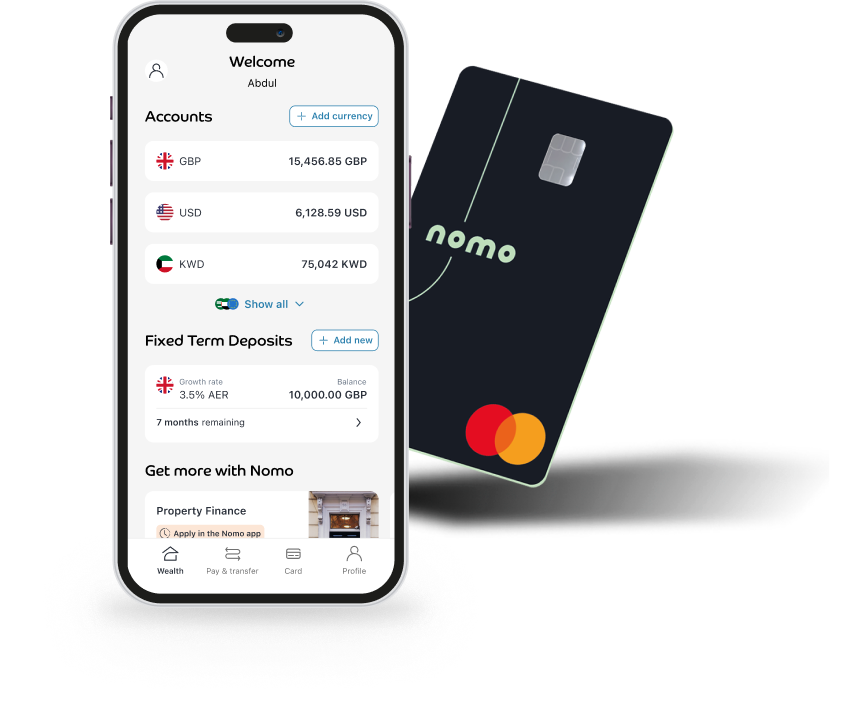

Grow your wealth with UK investment opportunities

- Fixed-term and instant access savings accounts in GBP, USD and Euro with competitive expected rates

- Property Finance for residential and rental properties in the UK**

- New international investment products coming soon!

**Your property may be at risk if you do not keep up the payments on your Nomo Property Finance

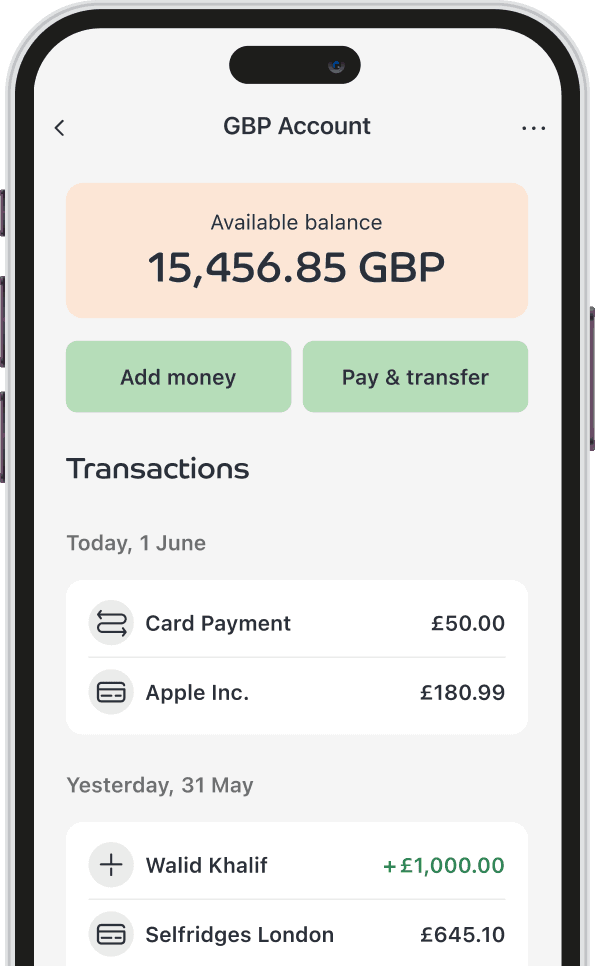

Banking solutions tailored to your international lifestyle

- Spend internationally in 6 different currencies with no fees

- Instant currency conversion through the app (GBP - USD - EUR - KWD - SAR - AED)

- Free ATM cash withdrawals in the UK (ATM rates may apply)

- Free and instant transfers to other UK bank accounts

*Eligibility criteria apply. Nomo accounts are not currently available to UK residents.

Secure banking

Your wealth is safeguarded with UK standard bank grade security.

FSCS protected

Deposits up to £120,000 are covered by the FSCS protection scheme.

Sharia-compliant banking

Banking that’s open, clear and based on the principles of Islamic finance.

Nomo by Bank of London and The Middle East plc (“BLME”) is a trading name of BLME. BLME is registered in England and Wales (no. 05897786), authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. BLME’s Financial Services Register number is 464292 and registered office is at 20 Churchill Place, Canary Wharf, London E14 5HJ.

We will collect and process information about you that may be subject to data protection laws. For more information about how we use and disclose your personal data, how we protect your information, our legal basis to use your information, your rights and who you can contact, please see our privacy notice.