About Nomo

What is Nomo?

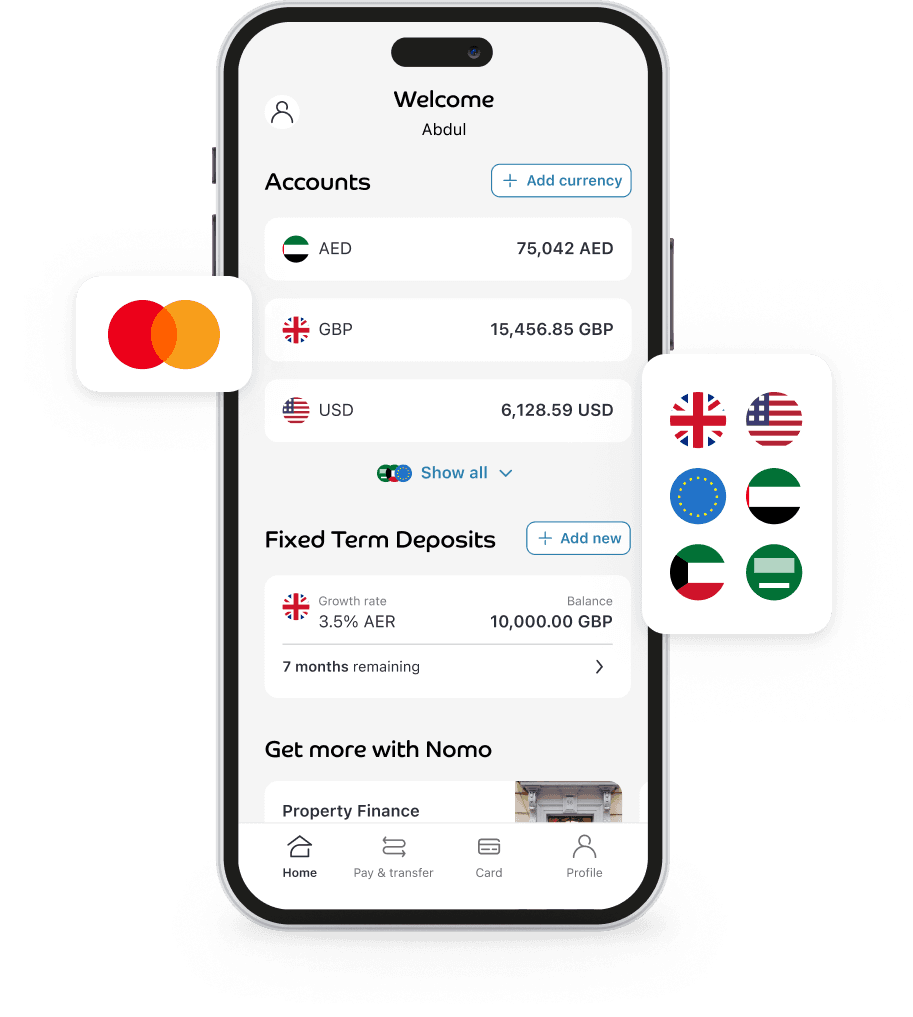

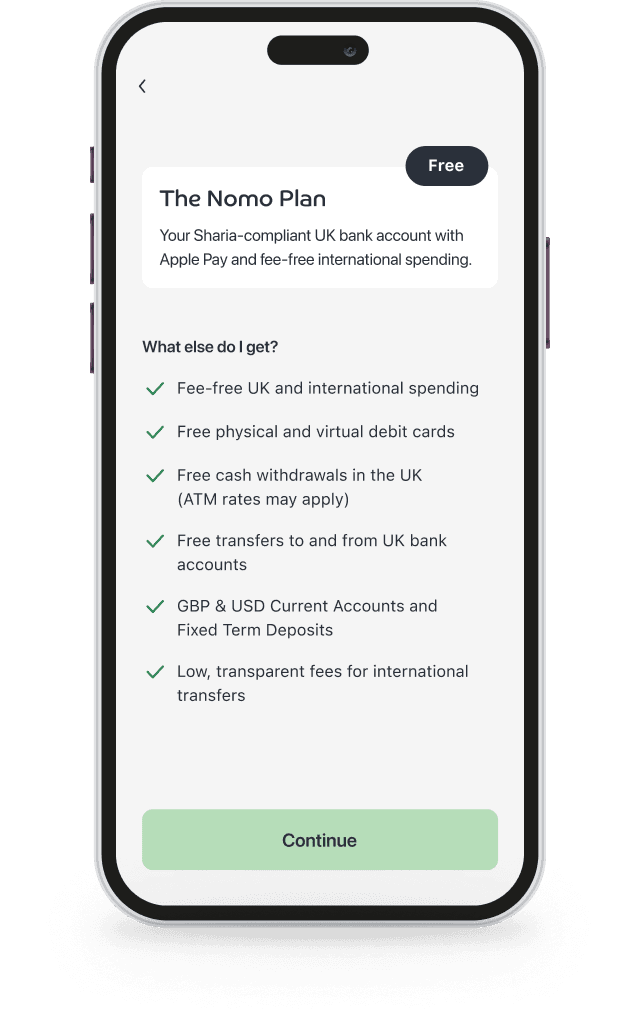

Nomo is a UK-based, Sharia-compliant digital bank. It’s designed for people with international lifestyles who want to manage their money easily through smart, simple and secure technology.

Who are we?

We’re a team of innovators drawn together from across the world of banking and payments with one clear vision: to create a new digital future for Islamic digital banking.

Nomo is part of Bank of London and The Middle East plc (BLME), a subsidiary of Boubyan Bank – a leading Islamic bank in Kuwait – renowned for its excellence, dedication to customer service, and market leadership in innovation.

The Nomo app combines these elements with the very latest banking technology, creating an immersive, international digital banking experience for our clients.

What do we believe in?

We believe that people should have instant access to amazing banking products 24/7, no matter where they are. This is even more important for those with international, fast-paced lifestyles, who aren’t tied down to a single location.

Nomo’s seamless banking tools allow you to live like a local even when you’re far from home. Wherever our clients go, they take their financial freedom with them thanks to our Sharia-compliant digital bank.

We’re working hard to bring digital excellence to the world of Islamic banking through cutting-edge technology that lets customers manage their money on their terms.

How are we different?

At Nomo, we understand that your lifestyle is dynamic, and we’ve got the digital banking tools to match.

-

Our sign up process can be completed in just a few taps on your smartphone. We’ll get you up and running in minutes rather than months.

-

Spend, send or save your money without high fees and hidden charges.

-

Enjoy instant access to your finances - Nomo is a digital bank that fits in your pocket.

Are you ready to begin the journey?

Be one of the first to experience Sharia-compliant digital banking.

Nomo by Bank of London and The Middle East plc (“BLME”) is a trading name of BLME. BLME is registered in England and Wales (no. 05897786), authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. BLME’s Financial Services Register number is 464292 and registered office is at 20 Churchill Place, Canary Wharf, London E14 5HJ.

We will collect and process information about you that may be subject to data protection laws. For more information about how we use and disclose your personal data, how we protect your information, our legal basis to use your information, your rights and who you can contact, please see our privacy notice.