Say hello to the world’s first fully digital international Islamic bank!

Nomo Bank

18 Nov 2021

Welcome to the Nomo blog!

Here, you’ll find all of our latest news and articles, designed to help you get the most from your digital banking with Nomo. Our blog will cover a wide range of topics, and feature unique insights about digital banking, UK culture and the Nomo product.

To mark the full public launch of Nomo, we sat down with CEO Sean Gilchrist to get his take on the many benefits of Nomo, and why its launch is such a significant moment for global Islamic banking.

First of all, what is Nomo and what makes it so special?

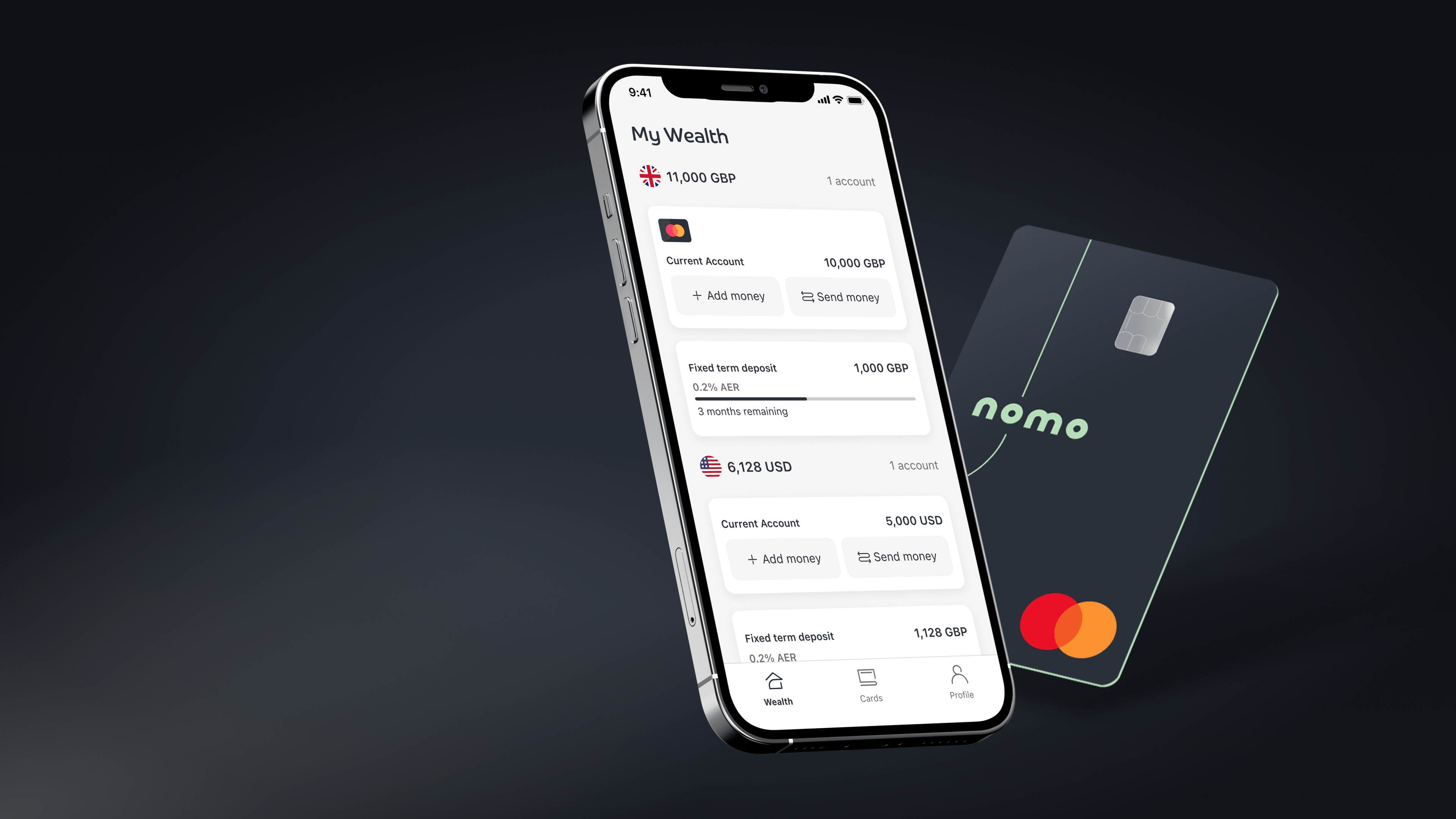

Nomo is the world’s first fully digital international Islamic bank. The clear and simple Nomo app gives you 24/7 control and visibility over your wealth, wherever you are in the world.

Everything from signing up, to making international transfers, to accessing UK investments, can be done in a few taps on your smartphone. Nomo is an international bank that fits snugly in your pocket!

What’s Nomo’s relationship with the UK, and what are the benefits that this brings?

Nomo is a trading name of BLME (Bank of London and The Middle East), which means that we’re a UK-based digital bank. This gives our customers the unique opportunity to enjoy the prestige, ease and assurance of UK banking, even if they aren’t British residents.

Some of the benefits include fee-free spending in GBP, free transfers to and from British bank accounts, and free ATM cash withdrawals in the UK. For anyone who regularly spends time in the UK, Nomo is the ideal bank account.

On top of this, Nomo deposits of up to £85,000 are protected by the UK’s FSCS (Financial Services Compensation Scheme), meaning that customers can bank with the confidence that their wealth is secure.

What types of accounts does Nomo offer?

We offer Current Accounts in both GBP and USD, giving our customers the chance to hold their wealth in two of the most secure and widely recognised global currencies.

Nomo also allows our customers to invest in the UK and grow their wealth in GBP and USD through our competitive Fixed Term Deposits, with a choice of rates and durations.

Why is Nomo so important for Islamic digital banking?

The work we are doing at Nomo shares the advances in digital banking and fintech from London with customers in the Middle East. We want to lay the foundations for a new future of Islamic digital banking which is driven by cutting-edge technology, improved accessibility, and excellence in customer service.

We hope that the example set by Nomo will encourage other fintech companies to digitise Islamic banking, creating a more prosperous future for customers across the GCC region and beyond.

What new features will you look to introduce soon?

Very soon we hope to add Apple Pay as a payment option, to make payments with Nomo even faster. Plus, we will be launching the Android version of Nomo in the near future.

We also have some more exciting investment opportunities on the horizon, including UK mortgages, so stay tuned!

Ready to get started?

Applying for a Nomo account is easy. It takes just a few minutes and can all be done on your iPhone. Once we’ve processed your application, we’ll send you your UK contactless debit card and it’ll be with you in 3-5 working days. However, you can start spending straight away by accessing your virtual card details in the app!

Nomo by Bank of London and The Middle East plc (“BLME”) is a trading name of BLME. BLME is registered in England and Wales (no. 05897786), authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. BLME’s Financial Services Register number is 464292 and registered office is at 20 Churchill Place, Canary Wharf, London E14 5HJ.

We will collect and process information about you that may be subject to data protection laws. For more information about how we use and disclose your personal data, how we protect your information, our legal basis to use your information, your rights and who you can contact, please see our privacy notice.