Introducing the Nomo Instant Access Saver

Looking for international growth but want easy access to your savings at all times?

Get both with an Instant Access Saver from Nomo, with expected profit rates up to 3.40%.

Immediate access to your savings

Earn profit daily on your deposits

Up to 3.40% expected profit rates

Deposits up to £120,000 are covered by the FSCS protection scheme

Access at any time

Have spare money sitting in your bank account? Put it to work in a UK-based savings account and grow it until you need it.

Profit accrues daily and is paid monthly, meaning you’ll start earning as soon as your Instant Access Saver is open.

Boost your expected profit rate

Be rewarded for depositing more in your Instant Access Saver. The larger your balance, the higher your expected profit rate.

We’ve got recurring transfers to help you automatically grow your savings towards the next profit rate threshold.

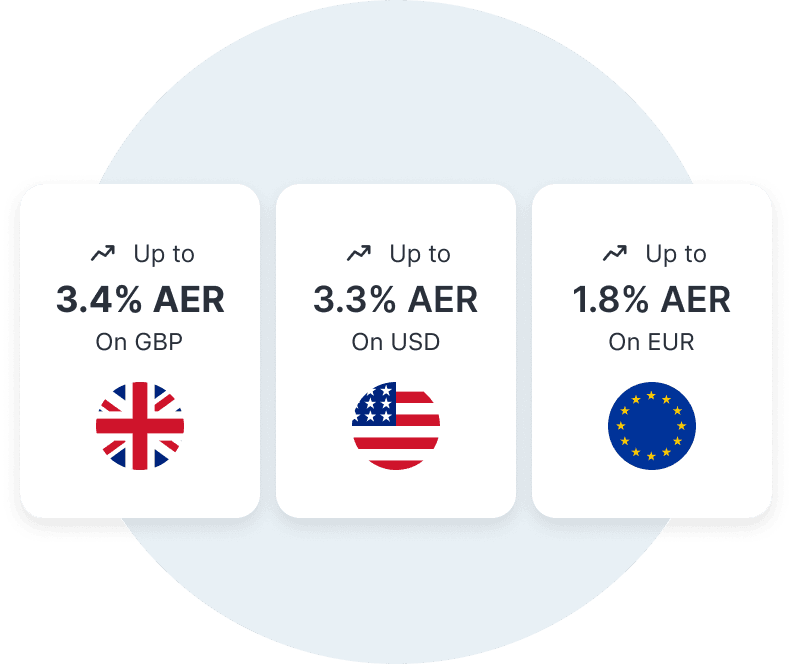

Earn multi-currency profits

Diversify your income and grow your wealth in different currencies.

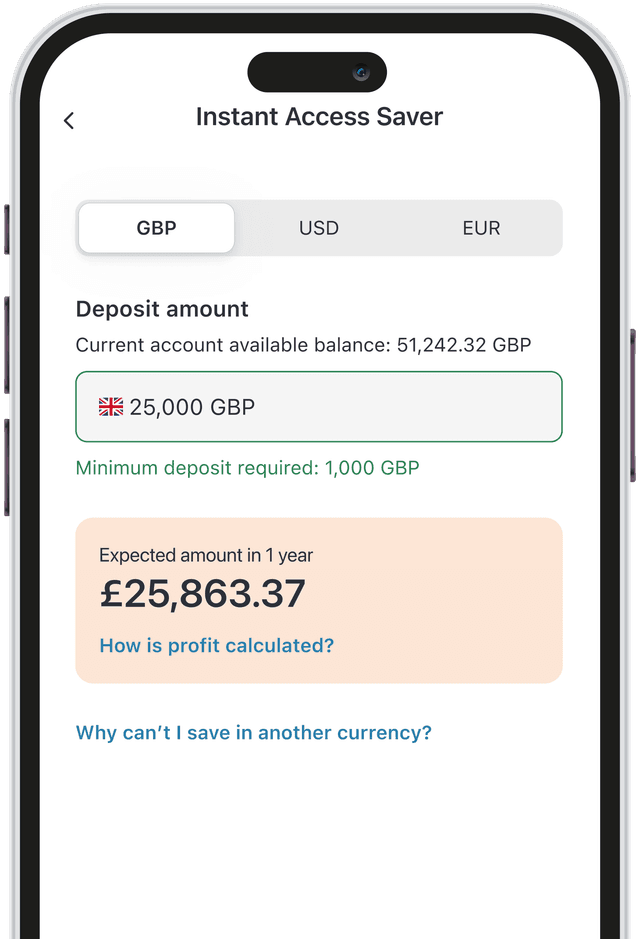

Nomo Instant Access Savers are available in GBP, USD and EUR, and you can open one account in each currency.

Minimum deposit 1,000 GBP, 1,000 USD or 1,000 EUR.

Instant Access Saver summary box

View our Instant Access Saver Summary Box as a PDFYes, the profit rates are variable, and we will notify you if we reduce the expected profit rate applicable to the account and give you 30 calendar days' notice as described in the terms. You may close your account and have your money returned to you, otherwise we will keep your account open, applying the new lower expected profit rate.

If the expected profit rate has increased, we will apply it to your account immediately

| Account Balance | Expected Profit Rate % (AER) | Expected Profit after 12 months |

|---|---|---|

| GBP | ||

| £1,000 | 1.00% | £1,010.05 |

| £10,000 | 2.90% | £10,293.89 |

| £25,000 | 3.40% | £25,863.37 |

| USD | ||

| $1,000 | 1.00% | $1,010.05 |

| $10,000 | 2.80% | $10,151.04 |

| $30,000 | 3.30% | $30,544.48 |

| EUR | ||

| €1,000 | 1.00% | €1,010.05 |

| €10,000 | 1.50% | €10,151.04 |

| €30,000 | 1.80% | €30,544.48 |

These illustrations show what a future balance might look like. They assume:

- You don't make any deposits or withdrawals during the period

- The profit rate does not change

- The profit is paid into the account monthly

You can open, view and manage your Instant Access Saver in the Nomo app.

- You must have an active Current Account open in the respective currency.

- There is a minimum deposit required from your Current account to open the Instant Access Saver. This minimum balance is required to keep the Instant Access Saver open:

- 1,000 GBP

- 1,000 USD

- 1,000 EUR

- You can hold up to a maximum deposit of 1 million GBP, USD or EUR in each Instant Access Saver.

- You can deposit more money into your Instant Access Saver at any time after opening with your initial deposit from the available funds in your Current Account.

- For additional support, you can contact a member of our team by email at support@nomobank.com or by phone on +44(0) 20 4587 1715.

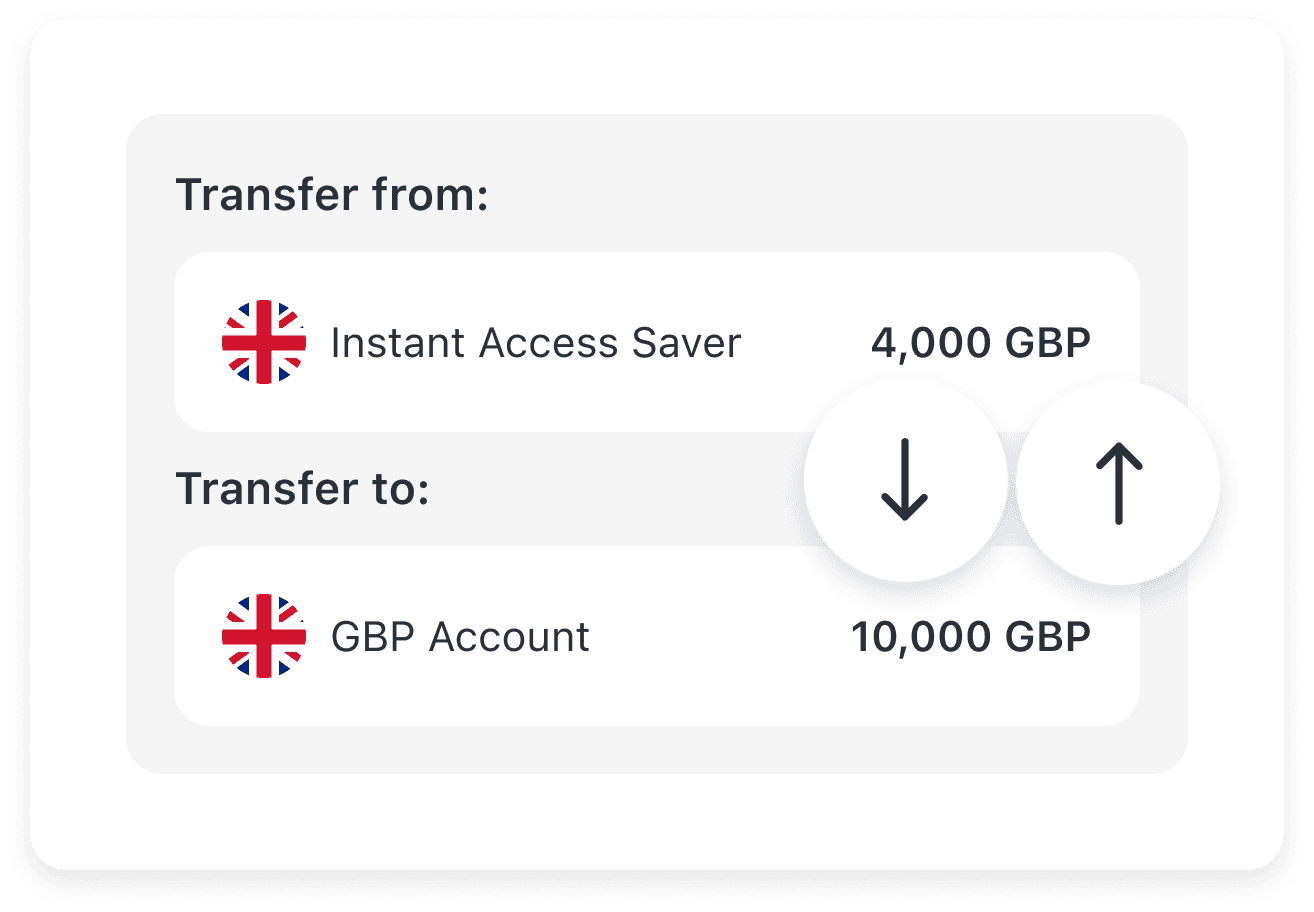

Yes, you have instant access to all your money in this type of account (provided the minimum balance is kept in the account), you may withdraw some or all of your money including any profit due to you, from your Instant Access Saver account to your Current account, and close your Instant Access Saver at any time in the Nomo app.

- You can have one Instant Access Saver in each currency that is available to you.

- AER (Annual Equivalent Rate) is the expected profit rate shown as a percentage that represents the amount that the savings account would earn, it tells you what the savings account would earn, it tells you what the profit rate would be if your balance was held for one year.

- The gross profit rate is the profit payable without deducting any tax. We do not provide any tax advice to any account holder or any other connected party. You should ensure that you obtain suitable tax advice in relation to the accounts held with us.

- We do not pay interest on your Account like most providers of savings accounts, and we do not use your money for prohibited interest-based lending. Instead, we place the amount you deposit in your Account in Sharia-compliant investments as your agent, we will then calculate the profit on your deposit daily and pay it to you.

- From time to time, we may have preferential profit rates for promotional purposes for specified periods, these will be communicated during these promotional periods.

- If your withdrawal from your Instant Access Saver results in the balance falling below the minimum balance threshold, you will need to withdraw all of the money in the account, and your account will be closed. You can open a new Instant Access Saver at any time.

Nomo by Bank of London and The Middle East plc (“BLME”) is a trading name of BLME. BLME is registered in England and Wales (no. 05897786), authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. BLME’s Financial Services Register number is 464292 and registered office is at 20 Churchill Place, Canary Wharf, London E14 5HJ.

We will collect and process information about you that may be subject to data protection laws. For more information about how we use and disclose your personal data, how we protect your information, our legal basis to use your information, your rights and who you can contact, please see our privacy notice.